- U.S Markets closed lower Yesterday.

- Most importantly , S&P 500 VIX closed above 25.

- This is a disturbing sign of option writers.

- When VIX goes higher put options go higher but CE do not fall proportionally.

- It looks like a short term Correction has begun in U.S Market.

- Asian markets and Dow futures are lower now.

- Just a few days ago , Nifty made a high of 18350.

- Yesterday's low was 17650.

- This is a massive correction of 700 points already.

- We are correcting because of Global Markets.

- A good thing happening due to this is we are going into Budget with less optimism.

- A positive or a no negative budget can turnaround this Market.

- Until then , I think we have to bear this pain.

- Yesterday was a downward trending day with last hour providing short covering rallies.

- Next support for nifty now is at 17500.

- Yesterday SGX Nifty hit a high of 17900 as Dow was up 500 points in first half.

- In 2nd half Dow fell 900 points from high and SGX crashed to 17700.

- Nifty might Trade between 17500 to 17800 today.

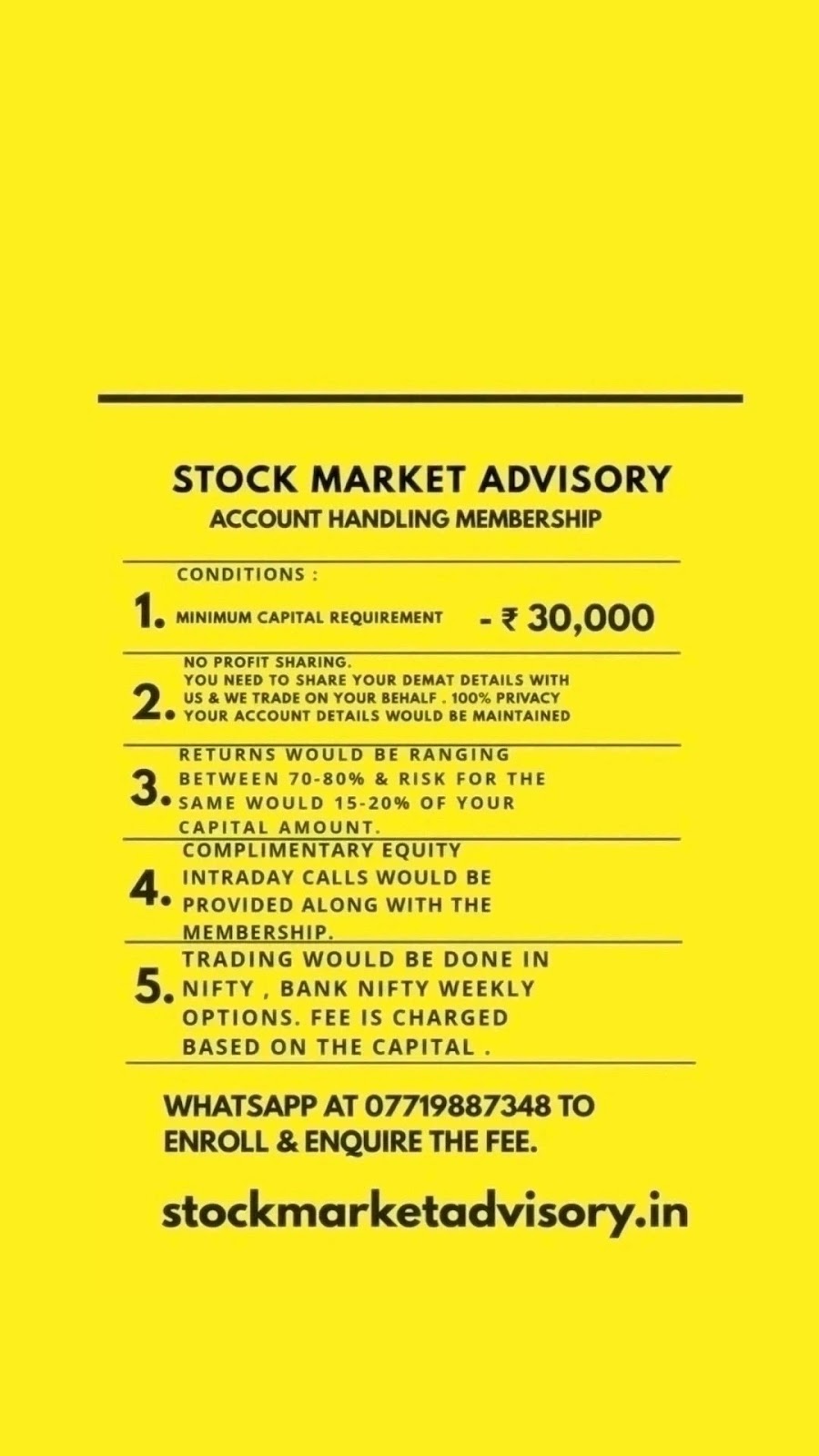

- stockmarketadvisory.in

1.U.S Markets closed higher Yesterday 2. U.S Futures are trading higher now. 3. Asian markets are higher. 4. Global cues are positive currently. 5. U.S Markets have made a short term bottom and now have reversed. 6. Gift Nifty is up more than 100 Points. 7. Yesterday was a big surprise to everyone. 8. Contrary to the exit Poll , things have been changed dramatically. 9. Exit Polls indicated a cakewalk win for the BJP. 10. Reality of the Ground level was entirely different. 11. There is BJP Govt forming but with a Coilition Govt. 12. Coilition Govt changes many aspects. 13. Firstly , the Govt cannot take decisions on its own. 14. It has to get approval of other parties as well. 15. This would hamper the growth prospects and future plans. 16. Last 10 years , the Government had come with a simple majority. 17. They worked freely. 18. This is a way good for democracy 19. One Govt dominating is not good for the Country , now everyone has to work for welfare of Country. 20. Com

Comments