- U.S Markets closed mixed on Friday.

- Right now Dow Futures and Asian markets are lower.

- SGX nifty is down 60-70 points near 18200.

- Last Friday as well we were almost having a similar set up.

- Global Markets were down and we opened gap down near 18150.

- During the day , this gap down was bought into.

- 18100 -18300 is the range for Nifty.

- Near 18100 is a good buying opportunity.

- In the past , I have noticed many times that in such broad ranges breakout usually happens on the higher side.

- So we have 90% chances of breakout above 18300.

- Whnen will this happen that nobody knows.

- Until then , buying dips close to 18100 is a good option.

- HDFC Bank has come up with results over the Weekend.

- These results look good.

- They are not too good nor too bad.

- It's an okay kind of results

- HDFC Bank has been beaten up so much in last 1 Month.

- Even average results could charge up this Stock.

- 38000 is a big buying zone for bank Nifty.

- It has rallied and reversed almost 4 times from this level and 18100 for Nifty.

- Nifty has reversed and gone higher from these levels about 3 times.

- Any fresh big move will happen only if we break 18100 or 18300.

- Until then it's a ranging Market with Consolidation on the upper side.

- Nifty might Trade between 18100 to 18300 today.

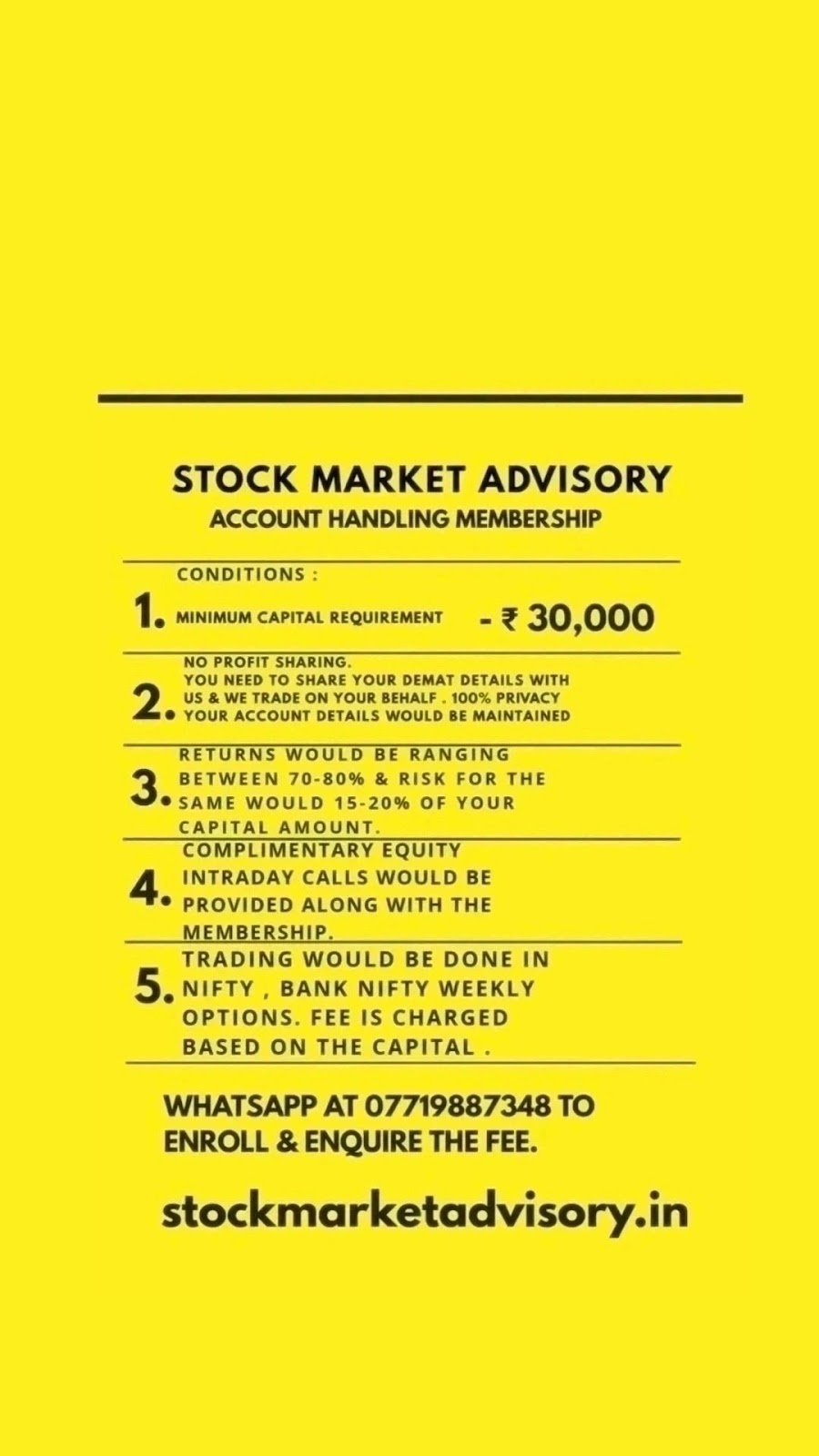

- stockmarketadvisory.in

1.U.S Markets closed higher Yesterday 2. U.S Futures are trading higher now. 3. Asian markets are higher. 4. Global cues are positive currently. 5. U.S Markets have made a short term bottom and now have reversed. 6. Gift Nifty is up more than 100 Points. 7. Yesterday was a big surprise to everyone. 8. Contrary to the exit Poll , things have been changed dramatically. 9. Exit Polls indicated a cakewalk win for the BJP. 10. Reality of the Ground level was entirely different. 11. There is BJP Govt forming but with a Coilition Govt. 12. Coilition Govt changes many aspects. 13. Firstly , the Govt cannot take decisions on its own. 14. It has to get approval of other parties as well. 15. This would hamper the growth prospects and future plans. 16. Last 10 years , the Government had come with a simple majority. 17. They worked freely. 18. This is a way good for democracy 19. One Govt dominating is not good for the Country , now everyone has to work for welfare of Country. 20. Com

Comments